Is it possible you Rating a home Security Financing in place of Refinancing?

You purchased your property a decade in the past therefore the costs was in fact 5% towards the a thirty-year fixed loan places Bessemer home loan. Inside 2024, you may get another type of home loan at the 3.5%. Protecting step one.5 issues on your the new mortgage will cut a lot of money monthly from your own percentage. In addition, it will reduce the focus money by the plenty across the mortgage term. In the past, a cash out home loan refinance is your best option.

Now, when you look at the 2024, new 31-season cost have been in this new 6% variety, thus making the 3.5% by yourself and you may pulling-out bucks which have an equity loan might be wise. More often than not, for people who already have a primary home loan about step three-4% range, but require cash to cover a different home or deck, a property equity financing will be a perfect options.

You can also pick a property guarantee loan that have a predetermined rate if you need to know accurately your rates and if the borrowed funds might be paid-in complete. If you prefer a lower life expectancy 1st speed and are usually comfortable with the pace changing down the road, a collateral range might be for you.

Certainly. You’ve got the option to availableness your own residence’s equity in the place of in the process of a great refinancing techniques on your current mortgage. Domestic security finance and you may House Security Lines of credit (HELOCs) are generally picked selection that allow you to borrow secured on the home’s collateral when you’re sustaining the initial financial plan.

Cash-out Refinance Considerations

The ability to score a cash-out re-finance otherwise a house guarantee mortgage mainly relies on your credit rating. In case the rating has actually decrease because you purchased your home, refinancing may not really works because your interest rate you certainly will rise.

Look at the borrowing from the bank in the about three big credit bureaus before you can sign up for a cash-out re-finance. Speak to your dollars-aside home loan company should your credit score isnt better more than 700 observe the way it can impact your own rates. Learn how a cash out refinance performs.

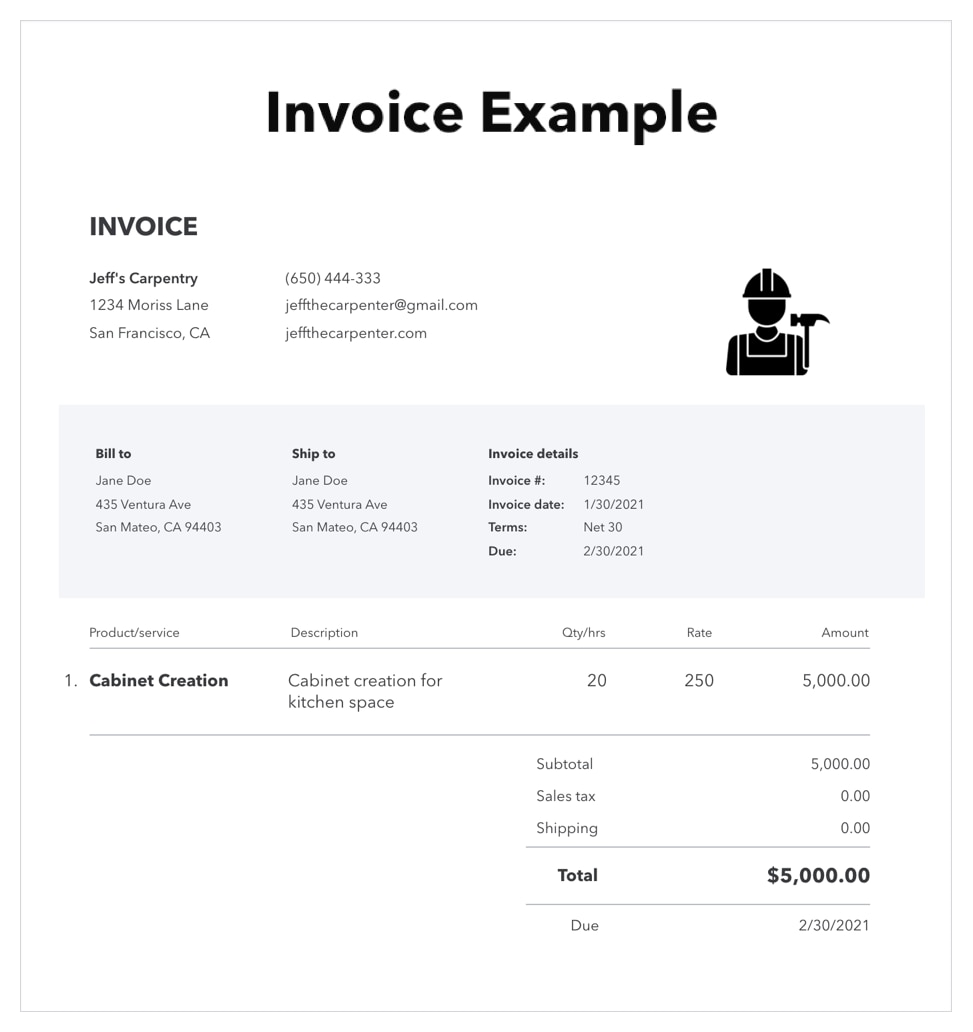

Getting an extra mortgage need you to definitely complete files to show you meet the requirements. A house guarantee loan and you can HELOC can have a comparable closure fees because the a first financial. A few of the settlement costs include an appraisal, attorneys charge, label lookup, and a software payment.

Exactly what are the Downsides of cash Away Refinances?

Normally having a cash out refinance, the fresh borrower are extending the term to possess 31-decades. This will offers the responsibility and you may mortgage debt consistently.

Just as in people mortgage, you will find a threat of foreclosures. Your property functions as security to the refinanced home loan. Incapacity while making punctual payments toward the latest financing you certainly will direct to help you foreclosures. Putting-off obligations resolution: When you’re with the dollars-out re-finance to repay large-attract credit debt, it is imperative to cautiously measure the long-title effects just before proceeding.

Might you Forfeit Your Interest rate When Cash-out Refinancing?

Yes, if you do a cash out re-finance your home loan is actually repaid and you reduce your mortgage rates and it’s make up for a special rate of interest which is connected to the cash-aside refinance.

Even though the rate of interest on the a collateral financing or HELOC might become greater than what you’ll come across which have a money-out refinance, you’ll not relinquish your existing mortgage rates, and also the closing costs may possibly not be since large. Which means this function for many who presently has actually a low interest on your established home loan while remove a property guarantee home loan, it will be possible to help keep your preciously low-rate.

Can you use the bucks You get getting Everything you Require inside Cash-Out Re-finance?

A finances-aside re-finance comes with the freedom to transform your house guarantee with the cash of the borrowing more your current mortgage, paying the last harmony, and remaining the extra. Specific financing underwriters will need the brand new debtor to enter a letter away from factor as to what he or she is by using the cash away getting on re-finance they are making an application for. In case your underwriter approves the mortgage, you’ve got the freedom to utilize money for different intentions, be it clearing credit card debt or renovating an out-of-date home.