Debt consolidating of the refinancing your house mortgage

The benefits

Given that mortgage loans is actually backed by a secured asset, the pace on the a mortgage is close to always straight down compared to interest rates towards most other expense, claims Brighten Lenders Federal Conversion Director Chris Meaker.

This can make debt consolidation reduction through a home loan decreased, about in terms of monthly payments. Prices towards the handmade cards might be a few times greater than a beneficial home loan’s.

Refinancing a mortgage in order to consolidate obligations have various positives near the top of all the way down full borrowing from the bank will cost you, claims Meaker. Its more straightforward to manage just one financing membership, eg, rather than of numerous – it means just one typical installment as opposed to multiple, making cost management convenient.

The risks

Debt consolidating does not mean your own other expense has actually vanished. Rather, you’ve mutual multiple smaller name bills into the financial. This have a tendency to expands the brand new commission period of the credit card otherwise private loan, says Meaker.

While this setting lower rates of interest minimizing month-to-month money, it may also imply a boost in the general price of your debt across the lifetime of the mortgage.

Jenny provides a good $400,000 financial with a speed of five.50% and you will a 30-12 months financing label. Their unique month-to-month repayments are $2,272.

She is served by a good $ten,000 personal bank loan loans which have good 3-seasons financing name and you can an effective 20% interest rate. This costs their $372 a month.

If she will be able to refinance to another 30-12 months mortgage with the exact same rates of 5.50%, her financial obligation commonly now be $410,000. However, their unique monthly money will be quicker, at only $dos,328.

It has solved Jenny’s instantaneous problem of high month-to-month costs. Although issue is one Jenny has brought an effective $10,000 personal debt that has been supposed to last three years and offered it so you can three decades.

More that time, she’ll find yourself using a unique $ten,000 only inside interest about financial obligation. Together with her original personal loan, she’d simply have reduced up to $3,3 hundred from inside the appeal.

However, Jenny’s brand new home mortgage allows her generate extra costs. This means Jenny normally offset the higher focus fees by paying out of a bit more monthly than their own lowest repayment. In the event that she paid down $50 a lot more 30 days she would end up protecting over $twenty-five,000 in the interest.

When you should extremely stop refinancing so you can combine financial obligation

Getting into more debt to help you pay other debts is obviously risky conduct. It’s simply worthwhile considering should your combination tends to make your payments way more down and you are sure you can deal with brand new costs in the future.

Debt consolidation reduction will not address this new perhaps high-risk actions you to definitely lead to your debt before everything else, states Meaker. The guy indicates individuals exactly who combine costs must not pull out the credit cards or financing avoid losing into the a financial obligation spiral.

- You happen to be credit funds from you to definitely resource to expend a different.

- You pay away from their bank card in order to start making way more instructions, entering financial obligation once more.

- You only result in the minimal payments on the credit card.

- You have over 3 different varieties of personal debt, as well as outstanding expenses.

5 Approaches for paying off personal credit card debt as opposed to refinancing

1. Consider an equilibrium import. Which have an equilibrium import you could potentially flow your own bank card expenses to a different mastercard that provides a time period of reduced or 0% interest. This provides your time and energy to pay off the debt.

2. Article a spending plan. Understanding how much cash currency you have to purchase each week, few days or seasons is a fantastic answer to recognize how much you really can afford to put on the diminishing your own credit debt.

3. Pay the high interest financial obligation earliest. If you have over step one bank card, put additional money on the paying off the greater interest credit earliest.

4. Pay more than minimal fees. Make payment on lowest repayment could keep you out-of challenge with your card provider, but may see your financial obligation paid at the a beneficial snail’s speed, definition you have to pay a huge amount of attract.

5. Shell out more than minimal fees. Make payment on minimum installment could keep your regarding trouble with your card issuer, but may see your debt paid during the a good snail’s pace, meaning you pay loads of desire.

eight tips so you can refinancing your residence financing in order to combine the money you owe

1. Feedback all your valuable expenses. Start by aiming all debts, like the number due, the interest cost and just how far you will be making every month from inside the payments.

dos. Look at your collateral. The latest security of your property ‘s the current value of the brand new property with no amount kept on your mortgage. If the residence is worthy of $800,000 as there are $350,000 left on the mortgage, then you’ve got $450,000 when you look at the guarantee instant same day payday loans online Nebraska. You should have about adequate collateral to pay for your bills to help you re-finance and bring your expenses to one another.

3pare loans. After you decide to refinance, comparison shop for a financial loan with a lowered rate of interest and you will features that fit your position. You are able to try to re-finance together with your most recent lender, that will help save you some time.

cuatro. Crunch the brand new wide variety. When you’ve receive a loan that looks a great, have fun with that loan cost calculator. Add up the complete home loan amount and all of their other expense, next figure out how far new monthly money was. Which count can be lower than most of the combined financial obligation repayments you’re already and come up with.

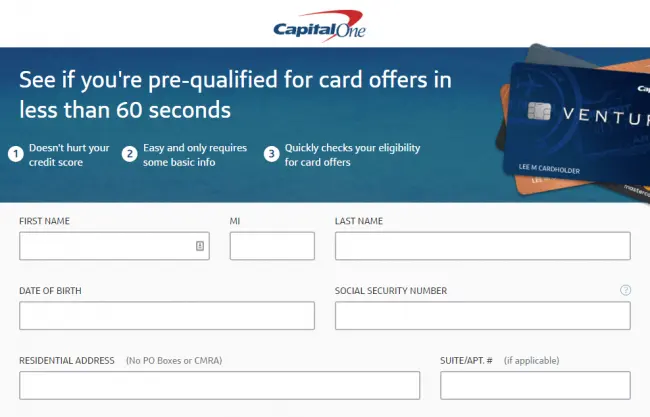

5. Submit an application for the newest mortgage. Get all of your mortgage files to one another and implement towards the fresh financing. When you have adequate collateral this needs to be easy enough, but with several costs the lender is generally more strict on your application. As a result of this it is best to dicuss in order to a good mortgage broker first implementing.

6. Work on paying off the fresh mortgage. Now that you have a single, long-identity loans, focus on investing it off. Build even more repayments in case the loan allows it. In the event the mortgage have a counterbalance membership, build-up specific deals inside.

eight. Stop entering next obligations. As much as possible stop taking out a separate unsecured loan otherwise borrowing card you might focus on their unmarried loans and get away from making past problems.