Password , which has been altered to cease unimportant arrangements discussing real home secured personal loans

Mortgage broker registrationA mortgage broker is set to help you suggest an organization one to receives, tries to get, otherwise facilitate in the getting a mortgage to have a borrower regarding a home loan company in exchange for idea or perhaps in anticipation off attention.

Mortgage loan founder licenseA real estate loan maker is placed so you can mean a person who, to possess compensation or perhaps in assumption away from compensation otherwise get, really does the after the:

For each RMLA registrant must have an office within the Kansas. After that, each prominent and you may department office of your registrant need to keep an effective independent certificate from registration. Operationally, the brand new RMLA requires a registrant to help you specify a procedures manager responsible for every single area, and should receive a surety thread for every single area at which it could be engaged in the latest controlled activity.

For every single real estate loan inventor licensee have to comply with specific proceeded knowledge conditions and may be applied by or of this an authorized lending company, mortgage broker, or an exempt entity. The brand new RMLA forbids good licensee away from working of the more than that mortgage lender, mortgage broker, otherwise excused entity at the same time.

The entities at the mercy of the fresh new RMLA must comply with fiduciary obligations and therefore are prohibited off acting from inside the an unjust otherwise inaccurate trends. These types of agencies should also keep all of the records composed or canned because of the an effective licensee, when it comes to providers transacted within the RMLA having several years, which the Superintendent ine as much as expected. HB 199 subsequent authorizes brand new Superintendent so you’re able to suspend, revoke, or refuse to matter or replenish a home loan company otherwise mortgage agent certification regarding registration otherwise a mortgage loan creator permit if the guy finds out, among other things, a solution from, or faltering so you can conform to, the fresh RMLA. HB 199 plus allows new Superintendent to help you demand municipal penalties to own abuses of your RMLA, also it offers violent punishment in some period.

Fundamentally, HB 199 lets customers to take an activity for data recovery out-of injuries to own a pass of the RMLA. The newest injuries approved need to be equivalent to all the compensation paid myself and you may indirectly on https://simplycashadvance.net/title-loans-ms/ the mortgage lender, large financial company, otherwise real estate loan maker out-of people origin, and practical attorneys’ costs and you can courtroom will cost you along with any punitive problems that will be provided.

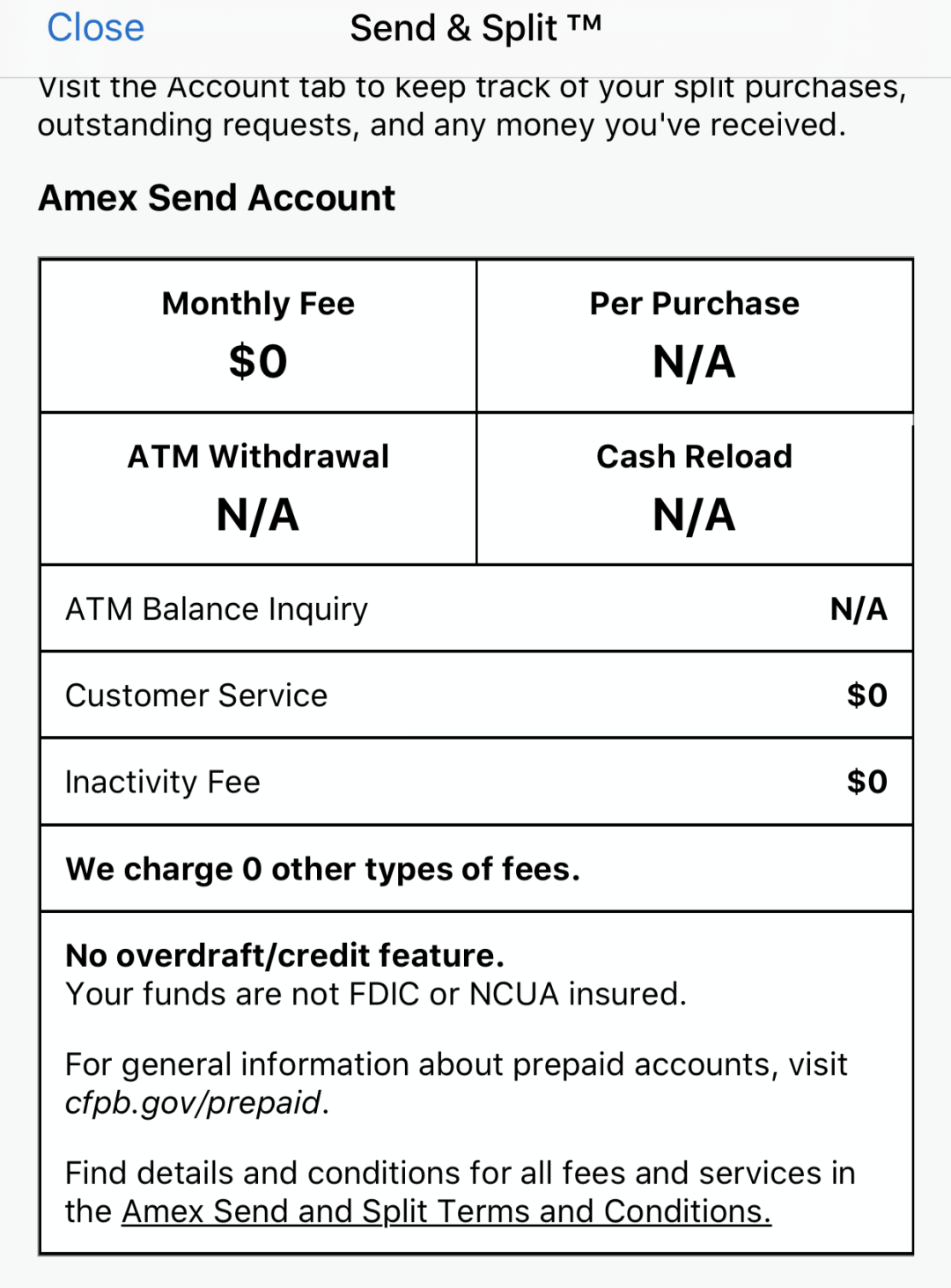

Fees and you may Charges

With regards to low-domestic mortgages produced in OMLA, the fresh OMLA retains their alternative twenty five% interest rate limitation and the thorough variety of let charge and costs inside Kansas Rev.

To own deals at the mercy of the brand new RMLA, the twenty-five% notice restrict was integrated; however, the brand new limitation would-be preempted to have qualifying lenders and make first lien funds that be eligible for federal preemption not as much as point 501 of your Depository Associations Deregulation and you can Financial Control Work from 1980 (DIDA 501). The brand new RMLA doesn’t come with a keen thorough listing of permitted charge and you may charges just like the number contained in Kansas Rev. Password . This is why, charges and you will charges try quicker regulated in RMLA than they was basically for financial institutions that have been and also make residential mortgages underneath the OMLA.

Disclosures

Over the years, the fresh OMBA and OMLA implemented numerous revelation conditions to have registrants and you can licensees. Yet not, as a way to improve and you will simplify Kansas rules, HB 199 provides repealed all the disclosure standards you to prior to now stayed. Lenders according to the the fresh RMLA need-not promote as the of many forms toward origination and closure out-of mortgage loans.

Still, the brand new RMLA nevertheless requires a number of disclosures. These revelation standards is user-up against disclosures, as well as others one to registrants otherwise licensees must provide yourself for the Superintendent. An individual-up against disclosures is: