Reasonable put? You might still score home financing

As to why everything is looking up getting very first home buyers

Basic home buyers from inside the New Zealand have seen it hard for a bit. Rates was in fact on the rise for years, and since 2013, LVR laws and regulations has suggested that customers you need a deposit of at the least ten%. If the average domestic pricing is approximately $700,000, preserving one deposit was difficult for many individuals.

But present changes so you can LVR limits mean one thing could get easier to have very first homebuyers in the future. Thanks to the COVID-19 crisis, LVR limitations have been got rid of, which means banking institutions you can expect to begin to offer a whole lot more lower-deposit money. And KiwiSaver gives, first house client funds, that assist from family members, thus giving lower-deposit consumers a great deal more choices than ever before.

Without a doubt, financial institutions nevertheless want to know they can get their money back after they lend to you personally, so they aren’t attending treat restrictions entirely. If you’re looking for this variety of financing, you really need to convince the financial institution that you have the fresh money and work out mortgage money and this you’re responsible sufficient to undertake a home loan.

A position and you will money

A constant occupations and you will consistent earnings are essential for all the home loan and more if you possess the lowest deposit. Extremely lenders will be trying to find evidence of a career and payslips during the last about 3 months. When you’re worry about-functioning or powering a business, you’ll probably be required to render evidence of online short term loan lenders steady trade to possess the past a dozen-two years. It’s about showing which you have an acceptable, secure money, just like the you are taking into a major responsibility in the way of a mortgage.

On account of COVID-19, banking companies is likewise concerned about redundancies and you will company closures, so they usually takes a glance at your own world certain circles try greater risk than the others.

Financing vs money

Low-deposit fund usually have some other payment conditions of numerous banking institutions and other loan providers would like you to repay the fresh basic 20% of financing immediately, to lessen their lending risk and set your in the same status due to the fact almost every other borrowers. They may require that you repay which first part of the mortgage on a high rate, as opposed to to make minimum payments.

In advance of you are acknowledged to help you borrow, they check your capability to provider such large payments you may need to offer an in depth funds to demonstrate you to definitely you can afford the loan next to their most other expenditures.

Capacity to save

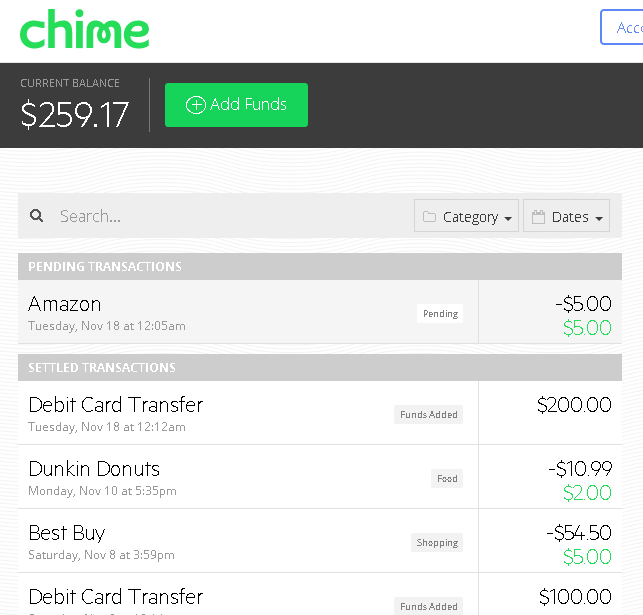

You may not feel the full 20% put, but if you can show you have managed to help save a significant throughout the years, they speaks concerning your power to reduce expenses and prioritise their home loan. You should have bank info appearing deals are placed over the years, in the place of a lump sum payment are considering as something special otherwise financing.

Credit history

A reputation not paying expenses otherwise and then make terrible economic behavior will truly make a difference with regards to a application for the loan. Banking institutions have to lend to those who’ll outlay cash back, and if you’re obtaining a reduced-put mortgage, that is doubly correct. Generally, a reduced-deposit mortgage are a different towards the usual financial statutes, which means that your app should be flawless a woeful credit record can damage the probability.

Other debts

Personal credit card debt, unsecured loans, car and truck loans, hire-purchase, also student education loans the more personal debt you have got, the newest worse it looks on your own application for the loan. A great deal more debt setting extra cash spent on most other repayments, and you will a reduced capacity to shell out your own home loan. If you are planning to apply for a mortgage, manage getting the debt under control first.

Way more choices for low-put individuals

You might establish your revenue and you may discounts, reduce your debt, whilst still being score rejected getting a decreased-deposit home loan. But that doesn’t mean you must call it quits your dream off homeownership there are other selection. Features, unique fund, that assist from relatives can every help you to get into the own home rather than an excellent 20% deposit.

Make use of KiwiSaver

If you are expenses on KiwiSaver for at least about three age, it’s also possible to qualify for a great Homestart give. Thus giving you $5000 to your put having a preexisting household or $10,000 towards a different sort of make. Whenever you are to invest in with somebody, meaning to $20,000 to your put that’s a serious improve.

You may also be able to withdraw most of your KiwiSaver efforts to place to your deposit these could make sense if you are purchasing towards a scheme for some many years.

Help make your own

Buying an existing property need a beneficial 20% deposit, but building off abrasion is fairly additional. Given that regulators really wants to remind the makes, you may only need an excellent 10% deposit to create your property. Naturally, this should be hard and you will pricey various other ways, so be sure to know very well what you’re going to get into earliest.

Score a specialist onside

Any your circumstances, purchasing your earliest house is complicated. You have to manage loan providers, function with dumps and you will papers, and apply to have gives otherwise unique fund if you need all of them. For this reason it’s very important to possess an expert mortgage broker on the class. Mortgage brokers cannot fees costs, in addition they meet your needs, so there is absolutely no disadvantage to getting help.

Their broker can counsel you and you can works out your alternatives, keep in touch with the lending company for you, make it easier to complete programs, and make certain you have made the best financing, reasonable put or not.