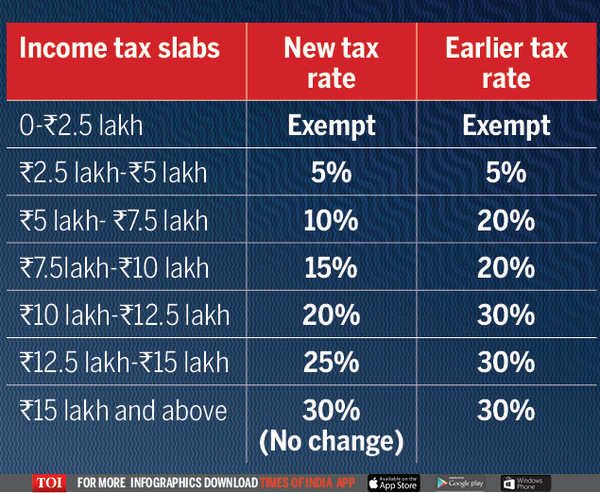

A quick Illustration of Zero Doc Financing Rates:

Anytime the lender now offers a level speed of 5%, this new documents hit alone often push the interest to 7%

- The current iteration are called Non-QM finance

- Because they do not meet up with the Licensed Mortgage signal

- Plus they are more challenging to qualify for compared to dated of them

These days, you’ll end up hard-pressed locate a no files loan, but if you manage, it will probably require a high FICO rating, usually more than 700.

After all, when your financial has only borrowing to be on, they should ensure you are not a big credit exposure. Consider, they will not know any single thing otherwise in regards to you, so lending to help you a family member not familiar with less than perfect credit wouldn’t make far experience.

And continue maintaining in your mind that pricing improvements to have Zero Doctor might possibly be high whether your financing-to-value are 80%, tend to regarding two items to the speed.

The question you will want to question is when its value taking that financial whenever you just go Zero Doc.

It can be advisable to wait if you do not offer a much better amount of papers to open the loan system options and sustain your own home loan price on a reasonable level.

Without a doubt, if you actually want to purchase a property, or have serious need of an effective re-finance, a no doctor loan is generally their only option. And if at all possible you might refinance a https://paydayloansconnecticut.com/indian-field/ short time afterwards to receive so much more beneficial terms.

This is exactly even more cause to properly ready yourself to possess home financing by continuing to keep your credit scores who is fit, putting away property, and keeping steady a position background.

Tip: You can even want to consider a stated income loan, which come having far less rates improvements, yet , enhanced self-reliance regarding qualification. He or she is becoming a lot more preferred once more that can nevertheless meet your requirements.

Anytime the lending company even offers a par rate of five%, the documentation hit by yourself will push your rate of interest to 7%

- Writer

- Previous Postings

Anytime the lending company offers a par rates of five%, the newest documents strike alone commonly drive your interest rate as much as 7%

- ount Secure-In –

- Performed Mortgage brokers Raise The Early Bird 2025 Compliant Financing Limitations Way too high? –

- People Double-Hand Financial Prices from the eighties Necessary You to definitely Pay Points Too! –

forty two thoughts on No Documentation Mortgage loans

Seeking use 150K against the house respected in the 350K which have zero mortgage. Trying to pay back playing cards, spend taxation costs, and you may restart a business that i was a student in to own 15 years. In search of zero doc loan.

As the mortgage-to-value is quite lower, to 43%, you may be able to qualify for like financing somewhere, maybe with a non-QM bank.

I have an effective jumbo mortgage who’s a drifting speed connected in order to good twelve-day treasury (dos.5%). I want to re-finance and repair it to good 15-season rates. I’m a retired without income however, deals. loan-to-value is very low, around 50%. Can there be ways to do refinancing no Doctor otherwise something different? (high FICO)

If you enough possessions you will be able to utilize all of them as the being qualified earnings for a loan. This might be labeled as advantage exhaustion otherwise a secured asset-established loan. You could contact some banking companies/agents to see exactly who also offers such loans whenever you’re qualified.

Listed here are my specifics. My personal parent’s faith produced my personal about three siblings and i owners of good townhouse from inside the Florida, valued from the 1.forty-five to at least one.65 million. I’ve the ability to order it from the faith for step one.one million. You will find a sum for the cost of up to 830,000 cash. Thus looking for somewhere in your local away from 250,000 to do the acquisition. It might seem this would be a straightforward financing with not a number of papers since the worth of the property far is higher than the borrowed funds number. (this new house owes me personally brand new 830,000 850,000 cash. However, since the I’m resigned and do not provides enough money (today, I have believe and you will class a property opportunities) I really don’t appear to have adequate earnings in order to meet lenders. I have a good 700 plus credit history (of up to 780 towards individual get), and then have always paid down all the my personal mortgages and you can expenses timely, and you will create continue doing so with fund We have. Will there be an easy way to do that?