Had Bad credit And require Your Home loan app acknowledged?

This informative article address contact information practical question usually requested must i get a mortgage in the event my credit rating is actually bad? Fico scores are concealed and you will from brain to own most of us. Up to, definitely, it’s time to score that loan also it becomes a problem. While a poor credit rating indeed makes it much harder to get home financing, it’s still possible. You need profits and discover how to get a mortgage with poor credit? Upcoming keep reading.

Should i rating home financing having poor credit?

Actually, we specialise within the exactly this type of difficult mortgage app. Getting a home loan having less than perfect credit is our talents.

What is a credit score or credit rating?

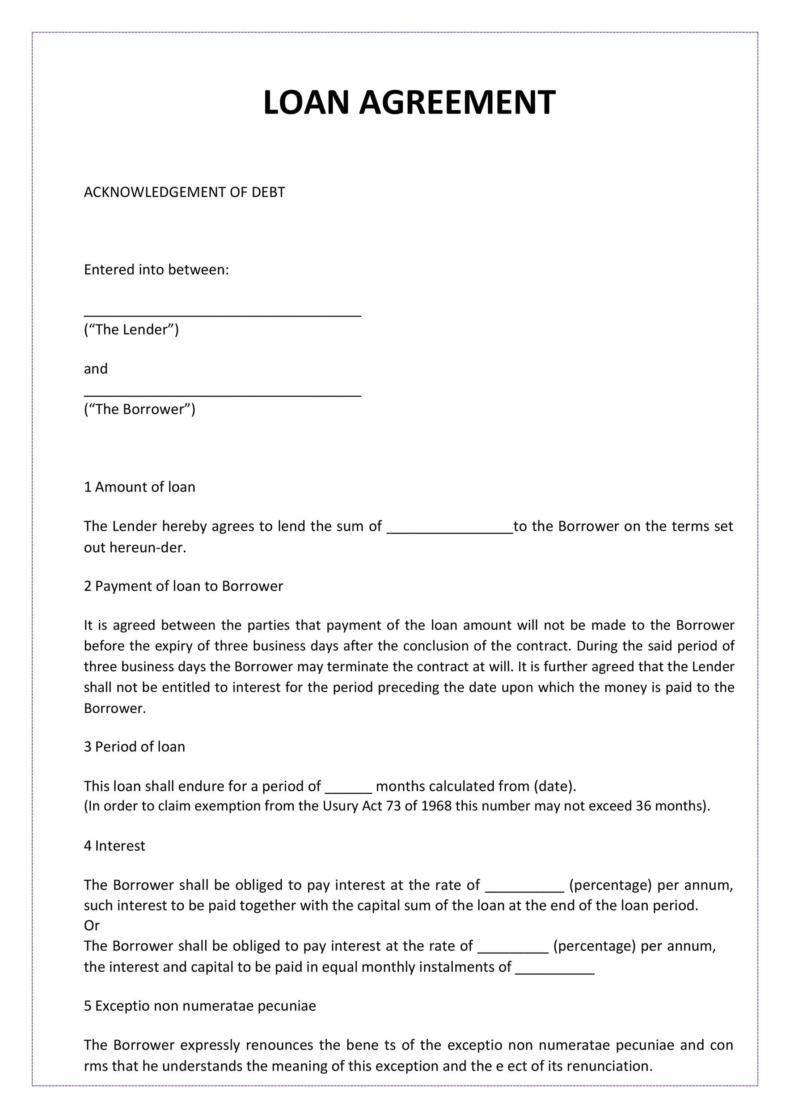

It is a rating that’s determined with the societal listing of credit score. This record is named the financing statement. A credit file includes guidance particularly loans you have taken out and people commission non-payments up against their term.

nicely amounts right up a default fee because a repayment that has been delinquent for over a month, and therefore the lending company has brought procedures to recover the fresh outstanding count.

An installment default would be some thing important, for example neglecting to build that loan fees. It might as well as relate to failing to pay a phone bill timely. Each other circumstances perform negatively effect your credit score.

- Fee non-payments

- Financial arrears

- Tax expenses otherwise defaults

- The otherwise later fine money,

- Bankruptcy

- Judge write-offs and you can

- Borrowing questions.

The amount of finance you really https://www.elitecashadvance.com/installment-loans-ia/oakland have in addition to their quantity may affect the get. Hire-get preparations and you can auto loans, instance, will negatively apply at credit rating.

If you need more information on borrowing suggestions and you will credit scores, we recommend everything web page. They details how exactly to can also be look at the credit file and you will do people points.

Why does my personal credit rating amount whenever obtaining that loan?

When you yourself have was able to work through our very own latest funds and you will are ready to undertake the fresh obligations from a mortgage, providing refuted on account of a history condition will be very challenging. It will help to consider you to definitely mortgages include large amounts regarding money, thus carry high risk into the lender as well as the borrower.

The lender have an appropriate obligations to make them financing sensibly. It is enforced of the Credit Agreements and you will Consumer Financing Operate (CCCFA).

How to rating a home loan basically features less than perfect credit?

A poor credit score form that loan away from a primary bank was unlikely. not there are numerous other low-lender lenders available. Non-financial loan providers specialize when controling people that wouldn’t rating a great loan that have a financial. They could offset the risk of credit so you’re able to someone with crappy borrowing from the bank by the billing a slightly large rate of interest compared to the banks.

The answer to effortlessly bringing home financing when you yourself have poor credit is to use a home loan specialist, like Platinum Mortgage loans. Therefore the big banking institutions, we handle of numerous great low-financial lenders.

We manage the records and can remove to each other an app that delivers you the best chance of qualifying. Anytime you’ve had their financial software refused of the a lender due to your credit score, don’t be concerned, we can let. Rare metal Mortgage loans The fresh Zealand Limited specialize in helping your when anybody else cannot.

Once you’ve got your house loan, the goal is to up your credit history within the next 2 years. We are able to next make it easier to flow your own mortgage so you’re able to a bank that have down rates. Alter your credit score by paying costs promptly, and simplifying obligations where you’ll.

In the event the after the day your money is carrying your straight back from providing a mortgage at this time, we can help you to get around. We could assists the new combination of your obligations so you’re able to take control of your debt, clean your credit report and you may enhance your credit score.

Check out our web page toward bad debts more resources for your home financing options. Otherwise forget to another action and contact me to initiate the newest discussion about precisely how we are able to direct you towards your specific affairs.