Home loan Top Right up: Best method Meet up with The necessity for A lot more Money

Financial Most readily useful Upwards: Most practical way To satisfy The need for Even more Financing

Several times after availing off a mortgage and achieving paid back the fresh new monthly payments for a few age, you might need more funds to address individuals casing issues. Or you could need just upgrade your property. In such cases, rather than trying to get another financing, you might go for a premier Upwards Financing on your existing home loan. This really is a less complicated and smaller way to program the required finance.

The major Up Loan definition suggests that its that loan you to creditors make available to their established home loan customers. Some banking institutions render a premier Upwards Loan simply for homes-relevant conditions.

How does a premier Upwards Financing Functions?

Once you apply for home financing for the first time, you may have specific mortgage eligibility that you can use. If you have burned up your loan restrict, you aren’t eligible for a special loan straight away; although not, if you have paid back a number of the loan along with your money has increased, your loan eligibility might have improved through the years. At that time, youre entitled to a leading Right up Mortgage including your current home loan.

However, your loan eligibility transform only over time has passed. Which is the reason why, constantly, banking institutions enables their existing home loan customers so you can borrow a great Greatest Up Financing just shortly after 6 in order to one year away from paying the last loan. Other than so it, there are several points to possess qualifying. So that you can score a premier Up Mortgage, you really must have an excellent repayment background. The financial institution contains the final state, which means your full background and you will experience of the financial institution can be together with affect the choice. The idea the place you you want a high Upwards Loan is in addition to taken into account.

Better Right up Loan Rates

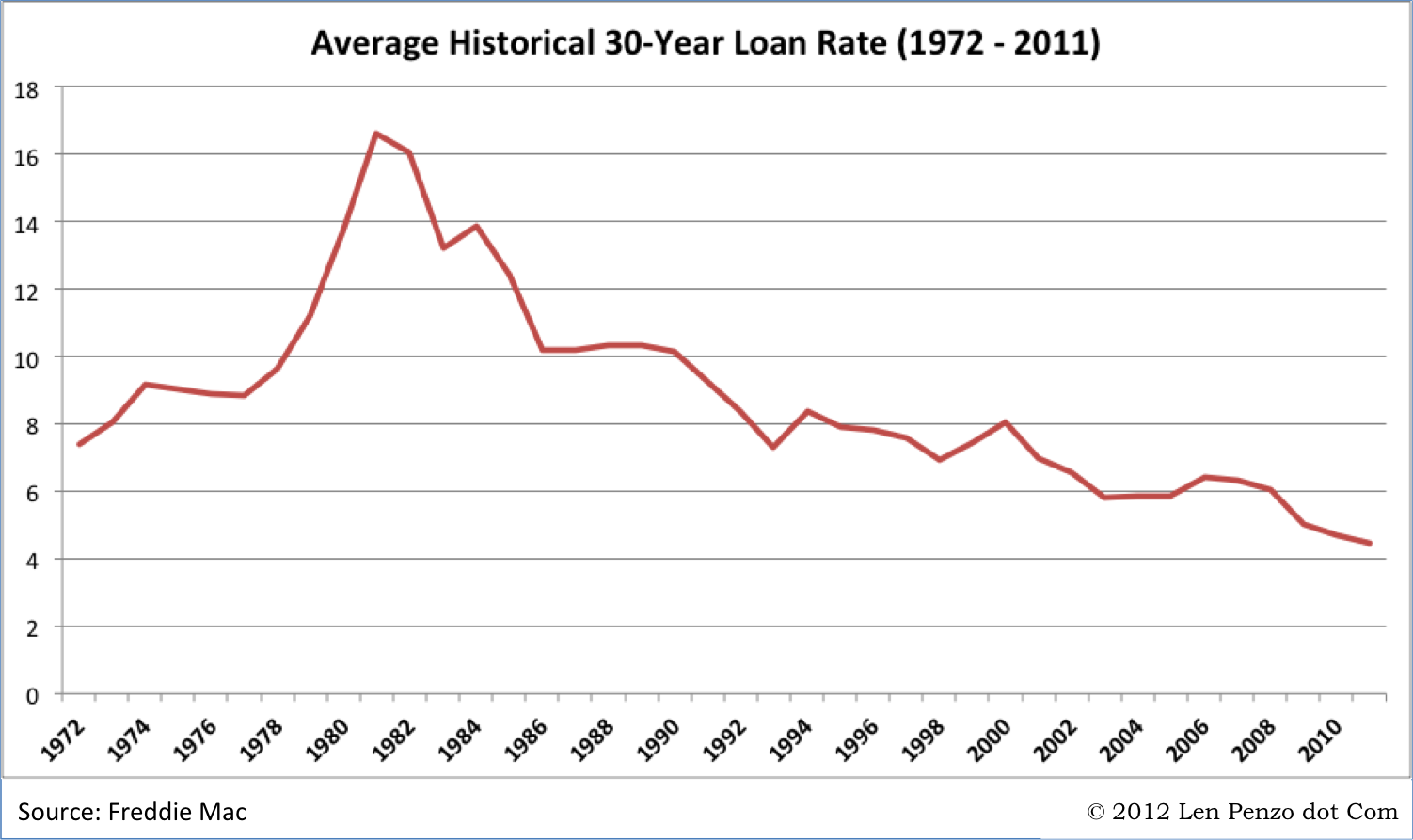

In comparison to mortgage brokers, Most useful Upwards Funds keeps a top rate of interest. He could be frequently considered an educated substitute for this new finance which have rates ranging from thirteen.5 to help you 16 per cent. The eye costs on top Right up Funds can differ based on the loan number your look for throughout the financial.

Eligibility getting a high Right up Financing

Financial institutions assess lenders in accordance with the property’s ount are deeper than 29 lacs, they may be able provide around 80% of one’s loan amount. Finance companies will accept a premier Upwards Mortgage in case it is possible to extend a whole lot more borrowing within the Financing so you’re able to Worthy of design. That’s when it is around 80% of property’s market price. They will certainly think about your month-to-month EMI once you’ve pulled our home loan, and repaired obligation so you’re able to earnings proportion for your Better Upwards Loan immediately following subtracting the installments of your latest loan.

Are there any Restrictions For the A leading Right up Loan?

Finance companies simply create such as finance offered immediately following 6-1 year or many years off high enough installment into a good mortgage. Ahead of like financing is offered, specific finance companies can get impose an extra status off achievement/hands of the house

A number of banking companies ount, that’s, the full total Finest Upwards Financing and also the the home loan cannot meet or exceed the original financial approve matter

The fresh new period is bound towards completely new loan’s an excellent period. If you have 8 ages left on the financial, the definition of of one’s Ideal Up Mortgage are not extended than just 8 ages

Greatest Upwards Online calculator

You need to understand that banks feet the loan computations in the market value of the home. If the home is worth over Rs 31 lakh, banking institutions within the Asia simply lend 80% otherwise less of its market value. You need to likewise have good credit to take on the additional obligations. Immediately following accounting for the constant domestic loan’s Equated Month-to-month Instalment (EMI), banking institutions should determine the level of the top Up Mortgage. You’ll be able to check your eligibility to have a top Upwards Loan using a leading Right up Finance calculator available on the banks’ and you can HFC’s websites. The major Upwards Finance calculator will instantly help you determine your own EMIs, according to research by the rate https://paydayloancolorado.net/green-mountain-falls/ of interest, tenure, and you can loan amount requisite.

The lending company usually calculate your Greatest Right up Loan Repaired-Obligation-to-Earnings ratio (FOIR) shortly after subtracting the costs for all your running obligations.

In a nutshell, a leading Up Loan is a better choice than just a personal financing. For many who already have home financing and then have a flush and you can a beneficial history of percentage previously, you’ve got a much better threat of delivering a premier Up Loan. In addition there are a ount when you have currently accomplished 3-cuatro years of your home mortgage payment. As certain mortgage rates of interest vary from 18 in order to 24 percent, it is always a smart idea to check out Greatest Upwards Financing.