How much does Financing so you’re able to Value (LTV) imply? | Just how to Calculate LTV

When you begin to consider mortgages plenty of terms and conditions and you can hype words’ is thrown around. There are numerous phrases that it is useful understanding and something regarding the initial ones if you’re trying to establish exactly how far you can afford to use is LTV otherwise Loan to help you Worth.

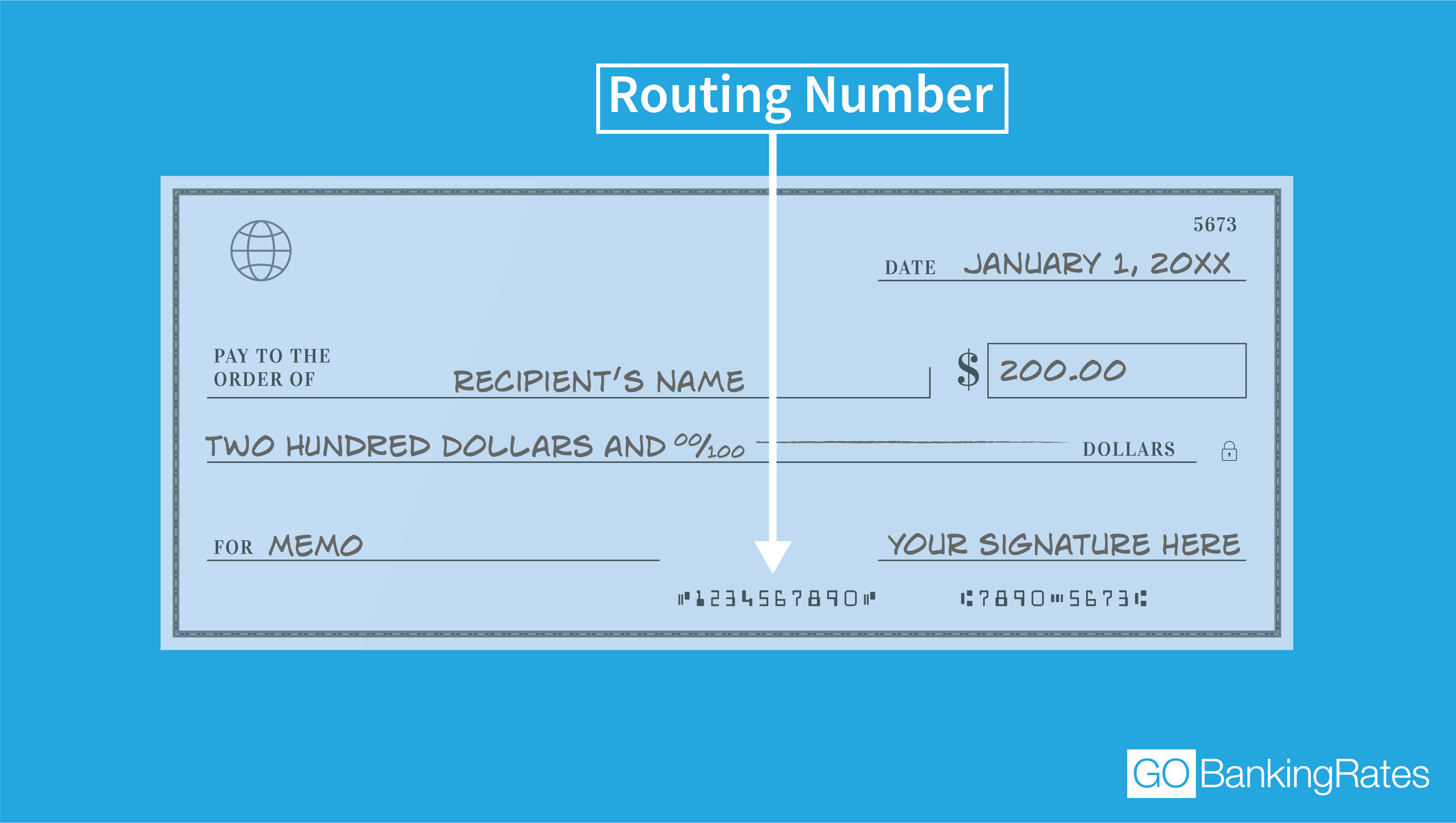

Loan in order to Worthy of is the percentage of loan than the the worth of the house or property. Instance, if your property is worth ?2 hundred,000 and you’re borrowing ?100,000, the LTV is actually fifty%.

If you’re to purchase property, the value could be more or less similar to the sum you may have accessible to pay it off, but sometimes a specialist valuer often differ. They may consider the value try large or straight down and that is very important – we’re going to explore as to the reasons later on. When you are re also-mortgaging or refinancing, you will need to discover the property value your home yourself. Its important that you is actually exact, therefore examining other sites including Rightmove or Zoopla could help

‘ Essentially, the principles are ready to protect the bank and debtor to reduce the risk of this new debtor to-be incapable of create their monthly obligations additionally the financial eventually providing fingers of one’s assets to sell it and get their cash straight back.

To reduce the probability of which nightmare’ circumstances going on, the financial institution will need to introduce the worth of the home he could be financing into the and also the borrower’s earnings, expenses, or other personal factors. Demonstrably the reduced your own LTV, the low the risk you perspective. In case there are a repossession, the financial institution may wish to have the ability to promote the home, go back the credit and additionally one accumulated notice and you can costs connected on the property revenue regardless if household rates features dropped once the it supplied the borrowed funds

Mortgage lenders has rigorous guidelines that govern their lending regulations, many of which was indeed imposed by the Authorities pursuing the 2008 credit crunch

Hence, the eye cost charge into the highest LTV mortgages can be notably higher than those individuals on straight down LTV financing.

On the other hand, the greater the LTV, brand new faster equity discover in the possessions if mortgage is actually taken out so the riskier the borrowed funds is always to the lending company

Very lenders want at least deposit of five% of your own cost providing an LTV from 95%. Mortgage Rates commonly treat during the groups of 5%, so if you can come up with an additional 5% and come up with your own LTV ninety%, you could get a better bargain. That it can be applied down seriously to an enthusiastic LTV of about sixty% where lenders dish out their utmost sales. In fact, issues on 95% may be doing step one.5% higher than men and women on sixty% LTV.

In addition to common standards lay by the lenders, when you begin looking at the mortgage loans available to you personally, this new lender’s restrict Financing in order to Worth (LTV) proportion will also determine what you can obtain as well as what interest rate. Therefore, you to, in short is Financing so you can Worth.

Trouble develop after you invest in get a home from the a good specific speed, in order to $255 payday loans online same day Colorado enjoys a home loan valuer put an excellent valuation into assets below brand new concurred cost. In such a case, the financial institution are always go with brand new Valuers research hence may well change the LTV.

Even when the deposit are big, it will feel you to a lower valuation tend to push your own LTV up and this might signify the speed goes right up too

When you do rating an all the way down valuation, the first thing to would is always to renegotiate the price to the importance put on it from the bank. Should your vendor refuses to do that, you really have problems. Whatever the case, might you want to buy a property for more than it is worth? Really manufacturers is realistic when confronted with a reduced valuation.

Basically, mortgage company require no less than either a 5 or 10% put and therefore has actually an optimum LTV of often 90 otherwise 95%. There is no minimum LTV, however some loan providers do have minimal mortgage items.

If you are a primary-big date customer and you’ve got questions about LTV percentages, feel free to contact the group from the Home loan Requisite. We offer elite group home loan recommendations therefore can provide a of good use insight into how a keen LTV may affect your chances of providing a competitive financial. We love providing earliest-big date consumers purchase the first house, we shall cut-through the fresh new jargon and appear the complete sector to acquire a mortgage that meets your circumstances and you can funds. Home loan Called for are dedicated to and then make obtaining a home loan just like the hassle-totally free that you could for our customers.