Try an FHA loan best for you?

FHA Lenders are among the best home loan options to own first time home buyers. Get a different sort of home with 3.5% down!

Associated Users

- Home

- FHA Financing

- Conditions

- Restrictions

- 203k Mortgage

- Rates

- Refinancing

Homeownership are an aspiration that many people share, nevertheless the cost of to purchase property shall be a life threatening barrier. FHA loans makes homeownership more accessible having borrowers which have lower credit scores, restricted offers, or even more financial obligation-to-earnings ratios.

FHA money try mortgages that are insured by the Federal Homes Management (FHA). New FHA makes sure such money to minimize the danger for lenders, making it simpler to own individuals to help you qualify for a home loan.

Advantages of FHA money

- Reduce commission requirements: FHA fund want a downpayment out-of simply step 3.5%, versus 20% for almost all conventional mortgages. This may ensure it is more comfortable for individuals with limited offers so you can pick a house.

- So much more lenient credit standards: FHA finance have significantly more easy borrowing conditions than simply conventional mortgage loans. Borrowers that have credit scores as low as 580 tends to be eligible to own a keen FHA mortgage.

Disadvantages of FHA loans

Buying a home the very first time would be overwhelming so you can say the least. In the event an FHA mortgage suits you is based on your private issues. When you have a reduced credit score, limited discounts, otherwise a top financial obligation-to-earnings proportion, an enthusiastic FHA loan is generally recommended to you personally. Yet not, it is critical to consider the pros and drawbacks out-of FHA financing before carefully deciding.

You will want to observe that FHA loans are not just to own first-date homeowners. FHA financing shall be a good option for the debtor whom matches brand new qualification FHA loan requirements.

If you are considering an FHA financing, it is important to communicate with a qualified lending company such LeaderOne Economic. For additional info on your options contact us today at the (855) 971-1050 .

FHA Financial faqs

A keen FHA mortgage is actually home financing insured because of the Government Casing Administration. FHA funds are created to assist straight down-money and very first-big date homeowners qualify for home financing with an increase of lenient borrowing from the bank and you can earnings criteria.

FHA lenders are around for whoever match the money and you can borrowing from the bank requirements place of the Federal Vredenburgh loans Property Government. This may involve very first-date homebuyers, lower-earnings people, and the ones with straight down credit ratings.

Minimal credit history to have an FHA financial is actually 580. not, particular lenders could have higher borrowing from the bank conditions, therefore it is crucial that you check with your lender observe what they require.

Minimal down payment having an FHA mortgage merely step three.5%. This makes it more comfortable for earliest-date homeowners otherwise people who have minimal coupons to buy a home.

Maximum loan amount to own an enthusiastic FHA financial may vary situated to the town the place you is actually to order property. In the most common portion, the most amount borrowed is actually $356,362.

The latest closing costs to own a keen FHA financial are generally down than others for a normal financial. not, the specific amount are very different with regards to the financial you choose, the type of home loan you choose, together with location of the assets youre to order.

The interest rate to own an FHA home loan may differ according to a number of products, as well as your credit score, the type of home loan you choose, together with bank you select. It is very important research rates and you can evaluate costs of other lenders for the very best rate to suit your FHA mortgage.

Yes, you could potentially refinance a keen FHA financial. Although not, discover restricted alternatives for refinancing, making it vital that you shop around and you may examine costs off more lenders to find the best selection for you.

Sure, you will need to pay mortgage insurance towards lifetime of an enthusiastic FHA home loan. This can soon add up to a tremendous amount across the existence of mortgage and increase the general price of homeownership

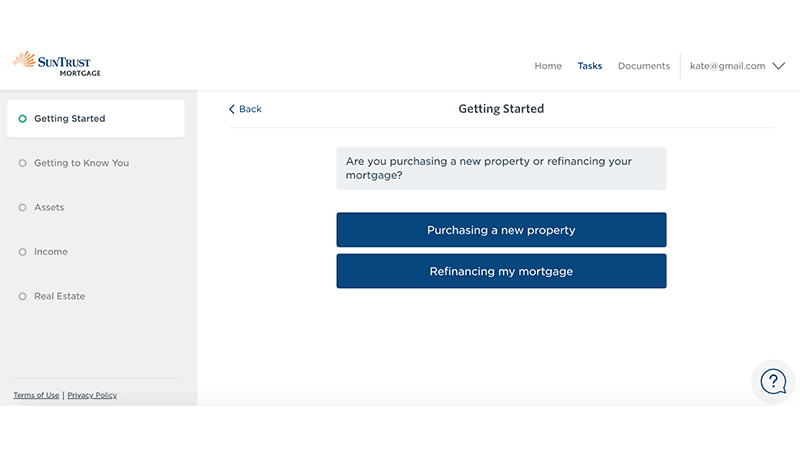

The process having acquiring an enthusiastic FHA home loan relates to shopping for a great bank, delivering pre-recognized to possess a mortgage, looking a property, and you can closure for the loan. It is critical to run a lender that is familiar with FHA home loans to make sure a silky and you can fret-totally free process.

FHA Home loans Achievement

FHA mortgage brokers can be good choice for people who have lower income, limited deals, or down credit scores. Which have lower down fee standards, more easy credit conditions, minimizing closing costs, FHA funds renders homeownership a reality for those who could possibly get has actually consider it actually was out-of-reach. Although not, it’s important to weighing advantages contrary to the cons, for instance the mortgage advanced and better interest levels, before making a decision.

Whether you are a primary-go out homebuyer otherwise an experienced citizen, it is very important seek information and you may consider any solutions before deciding on home financing. Into the right advice, you will find the mortgage you to definitely best suits your position and you will can help you achieve your dream about homeownership.