Well-known HELOC downfalls and the ways to avoid them

Opinion the statements daily to ensure you might be conscious of simply how much you’ve borrowed as well as how much you borrowed. Which constant overseeing allows you to stop overborrowing and ensure you is manage your repayments.

Prioritize payments

Within the mark months, work with generating compared to the lowest notice-just repayments. Repaying the primary during this time decrease the entire desire it is possible to spend across the longevity of the borrowed funds. As repayment period starts, focus on settling the fresh HELOC to attenuate a lot of time-identity will cost you.

Feedback interest levels

Because most HELOCs have changeable rates, stay advised on sector conditions. If the rates of interest go up notably, think refinancing your HELOC so you’re able to a fixed-rates loan otherwise settling the balance far more aggressively.

Plan for installment

As the draw several months closes, be ready for brand new installment months. Know the way your repayments may differ and just have a decide to do these the clickcashadvance.com 2000 loan bad credit new obligations. Envision changing your allowance or boosting your income to match highest payments.

When you’re property security credit line is an invaluable financial equipment, you will find prominent pitfalls to understand. To avoid such downfalls can save you out of economic worry and prospective adversity.

Overborrowing

Even though you happen to be approved having lots doesn’t mean you is put it to use all of the. Mark just what you need and can pay-off comfortably.

Overlooking charges

HELOCs will often have various charge, plus annual, maintenance and you can very early termination fees. Look out for this type of will cost you and basis them into your choice-and come up with process. Take a look at the conditions and terms and inquire regarding the any possible charge prior to you going.

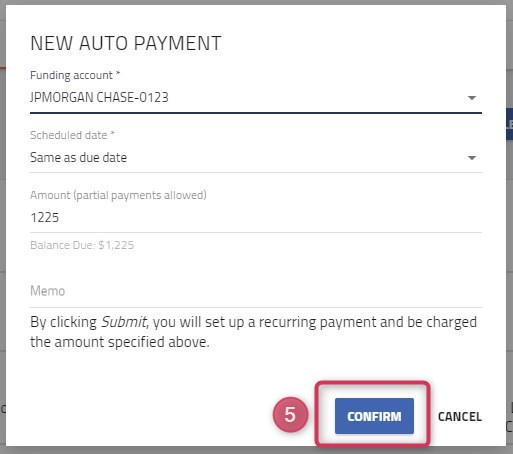

Forgetting costs

Failing continually to make fast money on your own HELOC can result in penalties and better interest rates. Regarding terrible circumstances, it does end up in property foreclosure, where the lender seizes your home. Set-up automatic reminders or money to be certain you never miss a fees. While you are not able to create money, get hold of your financial to go over the choices.

Variable rates of interest

HELOCs routinely have changeable interest levels, which can raise, leading to large monthly premiums. To decrease so it chance, imagine refinancing so you’re able to a predetermined-rates loan in the event that rates rise rather.

Misusing finance

It is best to use HELOCs to have debt consolidating, home improvements otherwise costs that provides enough time-title worthy of. Avoid using the amount of money for holidays, deluxe purchases or speculative expenditures.

Start your own HELOC travels now

Now you know what an excellent HELOC financing try and its own professionals, you could potentially action towards the leverage your residence guarantee. Regardless if you are thought renovations, consolidating loans or level unanticipated expenses, a beneficial HELOC mortgage offers versatile and you can possibly straight down-rates funding. Proceed with the tips and methods detailed to cope with your HELOC wisely.

If you have questions or you want personalized assistance, excite contact our Ent Borrowing Connection party. We’re going to help you since you navigate your financial travel that have count on. Begin their HELOC excursion today and you can discover the chance of their family equity.

What exactly is a house Guarantee Line of credit (HELOC)?

A property Guarantee Line of credit (HELOC) are a flexible and far huge personal line of credit that enables your to borrow on the house security you really have collected for the your property. It functions similarly to a charge card, offering a maximum credit limit. You might use as required during a blow months, constantly having varying rates of interest.

Why does a great HELOC vary from a property collateral mortgage?

A great HELOC provides an excellent rotating line of credit having varying appeal prices, allowing you to borrow as needed into the mark several months and you can generate interest-simply payments first. Having said that, a home security loan also provides a lump sum payment having a predetermined interest rate and you will fixed monthly premiums, so it is suitable for you to-date, high costs.