You can get accepted having a financial declaration mortgage instead proving people taxation statements

If you find yourself being in Sounds Town I encounter an abundance of artist household members who wish to buy home but come across obstacles because they are 1099 professionals. 1099 workers are separate designers that simply don’t found W2 money, and this lenders generally speaking agree much easier. Understand 1099 home loan approvals, be sure to get privy to exactly what loan providers select within the W-dos acceptance procedure. Lenders generally consult your last dos-Season Tax statements, a few latest shell out stubs & 60-go out bank report whenever approving a W-dos mortgage. Some tips about what I want to defense on this page!

Certain 1099 procedures were Hairdressers, Complete Techs, Photographers, Writers, Site Painters, Landscapers, Bookkeepers, Stars, Painters, Real estate professionals &, etcetera. So, if you find yourself in just one of these types of jobs, this post is to you personally!

Separate designers is actually lawfully capable write off company expenses out-of the fees making it tough to become approved having a mortgage loan

Fundamental authorities mortgages particularly FHA, USDA, Virtual assistant and even old-fashioned funds require 1099 employees so you can meet the requirements having the amount of money reported After their costs was in fact written from. I would like to forgotten particular white about how members of these types of disciplines can also go homeownership and take off some of the misunderstandings which come in addition to are a great 1099 staff!

The most used solutions you may have when selecting property when you find yourself getting a 1099 staff are listed below: Lender Report financing, one-seasons taxation go back review and dos-season average out of production.

Whenever qualifying 1099 loans, very lenders will have to select similar dos-12 months work background, but as we know extremely painters will never be choosing a cover stub of a family all 14 days, so just how would you become approved having a mortgage?

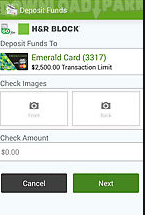

Lenders commonly be certain that arriving cash flow from your personal otherwise team bank accounts and rehearse averages because of these places since month-to-month earnings without having to remark people tax statements. Basically, when you can establish you are making cash on the 1099 occupations of the exhibiting dumps into your savings account, very lenders will meet the requirements your having an interest rate when your credit fits their requirements! Additionally you should be inside exact same business for at least two years and usually, the down-payment would-be dependent up on your credit history! Underwriters from the home loan businesses needs a great a dozen24-month breakdown of your own bank comments to see if you are going to be able to repay the mortgage. One of my personal favorite lenders, Arthur Blackburn, keeps a course where he can review a single-season income tax get back having a 1099 worker and you can decipher for folks who is also qualify for a mortgage. In lot of times, lenders will need a two-seasons average of your 1099 earnings to find out if your qualify. Including, in the event your 2020 1099 go back was $65,000 and your 2021 1099 go back reflected $130,000 then the income used to qualify for a mortgage manage feel $97,five-hundred. If you’re showing and you will $65,000 in 2021 next underwriters uses the newest cheaper of your 24 months therefore decline try these out.

Inside the realization, if you find yourself a good 1099 employee you have many options to help you safer home financing however, keep these circumstances in mind. Care for proper credit score and keep your very own and you can company ideas separate; be sure you come into your work having two years; try not to surrender and as always, contact a realtor. We have been right here making homeownership happens to you.

William Wilson was a prize-winning, multi-Million-dollars producer who may have a love when it comes to providing others. A great Nashville local and you will loyal representative known for their comprehensive keeps witnessed the great conversion to your city. Their intimate exposure to the location brings your new love and you will a desire to create their family your residence!